The Evolution of Ready-to-Drink Beverages

The ready-to-drink (RTD) beverage market is evolving rapidly, shaped by consumer demand for convenience, functionality, and health benefits. The industry has moved beyond traditional soft drinks to a diverse array of beverages incorporating functional ingredients, reduced sugar, and enhanced nutrition. With innovation at the core, brands are adapting to changing preferences and competitive pressures to stay relevant in this dynamic landscape.

Here are five key insights driving the RTD market forward.

1. Functional Ingredients Are Fueling RTD Growth

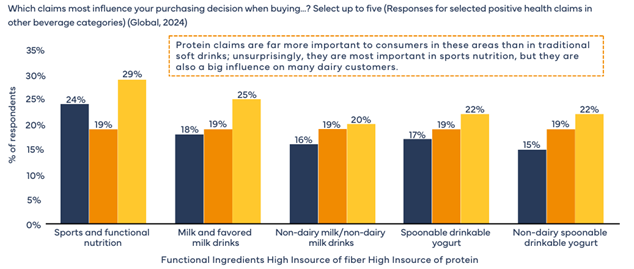

Consumers are increasingly looking for beverages that do more than quench thirst; they want drinks that support their health. Functional RTD beverages, which include ingredients like vitamins, probiotics, adaptogens, and antioxidants, are experiencing a surge in new product development (NPD).

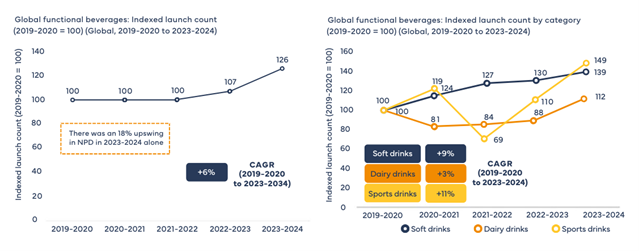

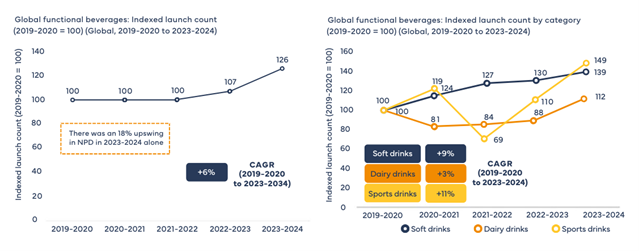

Global functional beverage launches saw an 18% increase in 2023-2024 alone,1 with soft drinks accounting for 46% of functional beverage launches, followed by dairy drinks (45%) and sports drinks (9%).2

Asian consumers are putting their money where their health is. Among consumers, some of the ingredients most valued include vitamins (73%), probiotics (55%), and antioxidants (51%)..3

From gut health to cognitive function, functional RTD beverages tap into consumer desires for proactive wellness solutions.

(Source: Innova Market Insights, Now & Next in Global Functional Beverages, August 2024).

2. Less Sugar, More Innovation

Sugar remains the top ingredient that consumers are actively limiting in their diets. As a result, RTD brands are reformulating their products with alternative sweeteners and reducing overall sugar content.

62% of global consumers say they prefer to cut back on sugar rather than use alternative sweeteners.4

Cane sugar (49%), brown beet sugar (38%), and Stevia (38%) are among the most accepted sweeteners in reformulated beverages.5

Energy drinks, in particular, are evolving with zero-sugar formulations and innovative flavor profiles in China, with brands like Red Bull and Celsius leading the way.6

Brands prioritizing sugar reduction while maintaining great taste will resonate with today’s health-conscious consumers.