Highlights:

There are several trends supporting growth in the clinical nutrition market:

- The improvement of healthcare infrastructure

- A growing elderly population

- The expansion of personalization

Three key trends are driving growth in the clinical nutrition market, creating new opportunities for nutrition-focused companies. Understanding these trends, along with the market size and top geographies for clinical nutrition products, can help companies assess their potential fit for this market.

There are several trends supporting growth in the clinical nutrition market:

The global clinical or medical nutrition market is estimated at $53.7 million for 2021, according to the latest report by market research firm Technavio.1 North America leads with about 34% market share, followed by Asia Pacific at 31% and Europe at nearly 28%. While the fastest growth is forecast for Asia Pacific at 8.9% (CAGR for 2019 to 2024), Europe and North America aren’t far behind at 7.6% and 6.7%, respectively.

The top three markets for clinical nutrition products are the US with 19% market share, the UK with 12%, and Germany with 9%. The presence of advanced healthcare facilities in these countries has helped make them leaders in the area of medical nutrition. The growth of the geriatric population in these countries, as well as in many other European countries and in Asia Pacific countries such as China and Japan, is also driving growth.

| Country | Market Share |

|---|---|

| United States | 19% |

| United Kingdom | 12% |

| Germany | 9% |

| Canada | 8% |

| China | 7% |

| India | 5% |

Enteral nutrition products make up about 56% of the global medical nutrition market, while parenteral nutrition accounts for the remaining 44%. The larger enteral nutrition market is expected to increase by $11.3 million (CAGR 7.3%) from 2019 to 2024, reaching $38 million. Parenteral nutrition is forecast to grow slightly faster (CAGR 8.4%), increasing by $10.2 million in the same period to reach $30.9 million.

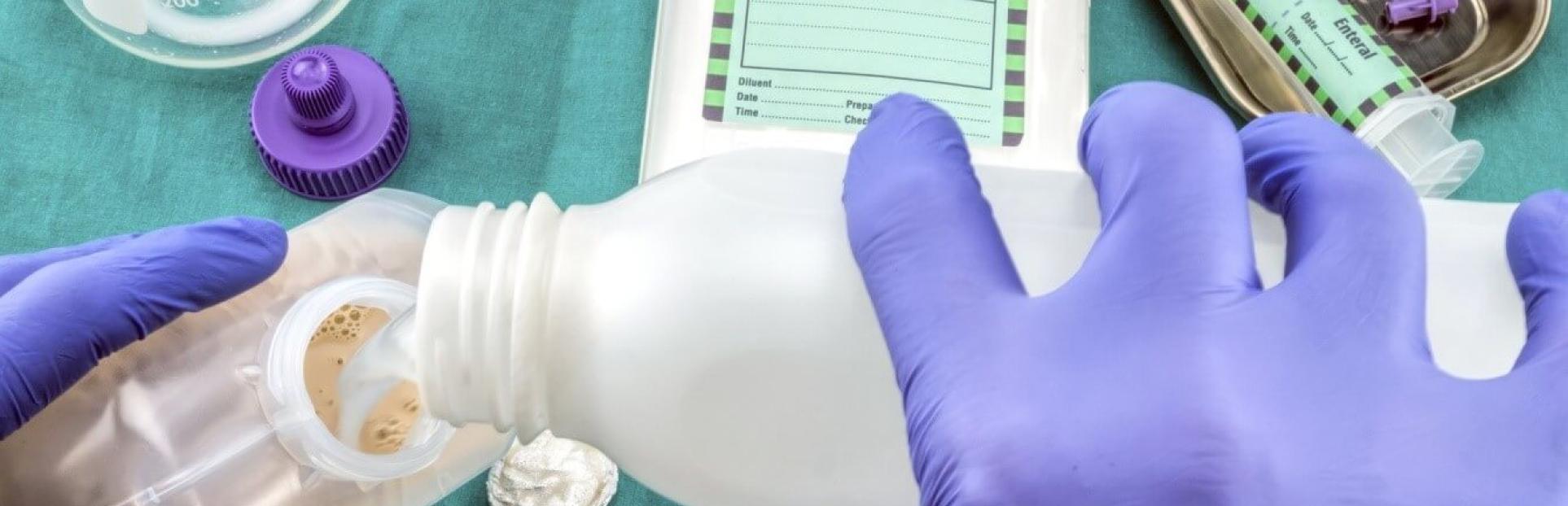

Enteral nutrition is the administration of nutrients directly into a patient’s digestive system, most often through tube feeding. This can be the best choice if a patient is unable to get enough calories through eating due to serious illness or injury. Enteral nutrition is also used if swallowing is difficult due to nerve or movement disorders.

The two types of enteral nutrition are standard and specialized formulas. Standard formulas, which are used in patients with normal nutritional needs, include proteins or amino acids, carbohydrates, fats, vitamins, minerals, essential fatty acids, and water. Specialized formulas for tube feeding address the specific nutritional needs of those with chronic illnesses such as AIDS, acute renal failure, and advanced cirrhosis.

Parenteral nutrition uses intravenous feeding to bypass the digestive system altogether. This is an option for patients with gastrointestinal disorders where nutrient absorption is impaired. Preterm babies may also rely on parenteral nutrition before they’re ready to transition to enteral feeding.

For those with chronic illness, the most important components of parenteral nutrition are often proteins, amino acids, vitamins, and calcium. Demand for parenteral nutrition is increasing due to an increase in births (which includes premature births), as well as a growing geriatric population.

Three important trends are contributing to growth in the clinical nutrition market:

In highly developed countries that have a high prevalence of chronic disease, healthcare infrastructure is becoming more sophisticated, which includes the use of clinical nutrition.

Many regions are experiencing growth in their elderly population—a group susceptible to chronic diseases that require clinical nutrition products during hospitalization and home care. This has been exacerbated by the effects of COVID-19.

Like other health and wellness categories, personalization is expanding in medical nutrition, with innovations that include more targeted formulas (for example Crohn’s disease, Alzheimer’s disease, and post-surgery recovery).

The growth ahead for clinical nutrition products represents a key opportunity for nutrition-focused brands. Glanbia Nutritionals’ customized premix solutions provides a way for them to simplify their internal processes. We offer product application development and market knowledge, in addition to high quality bioactive ingredients to meet your needs.

Contact us to learn more about our specialized capabilities in clinical nutrition.