Glanbia Nutritionals’ Consumer Survey

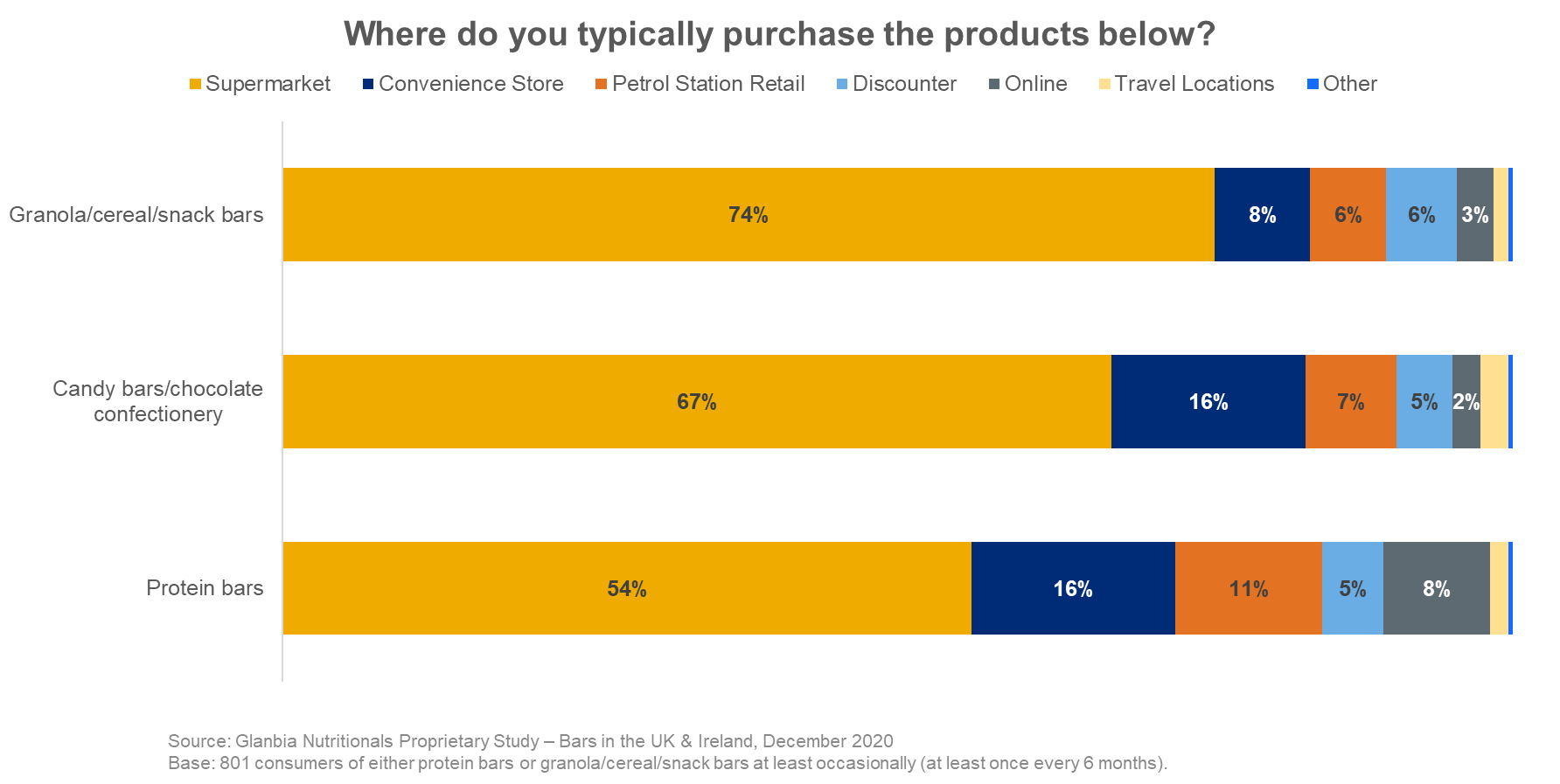

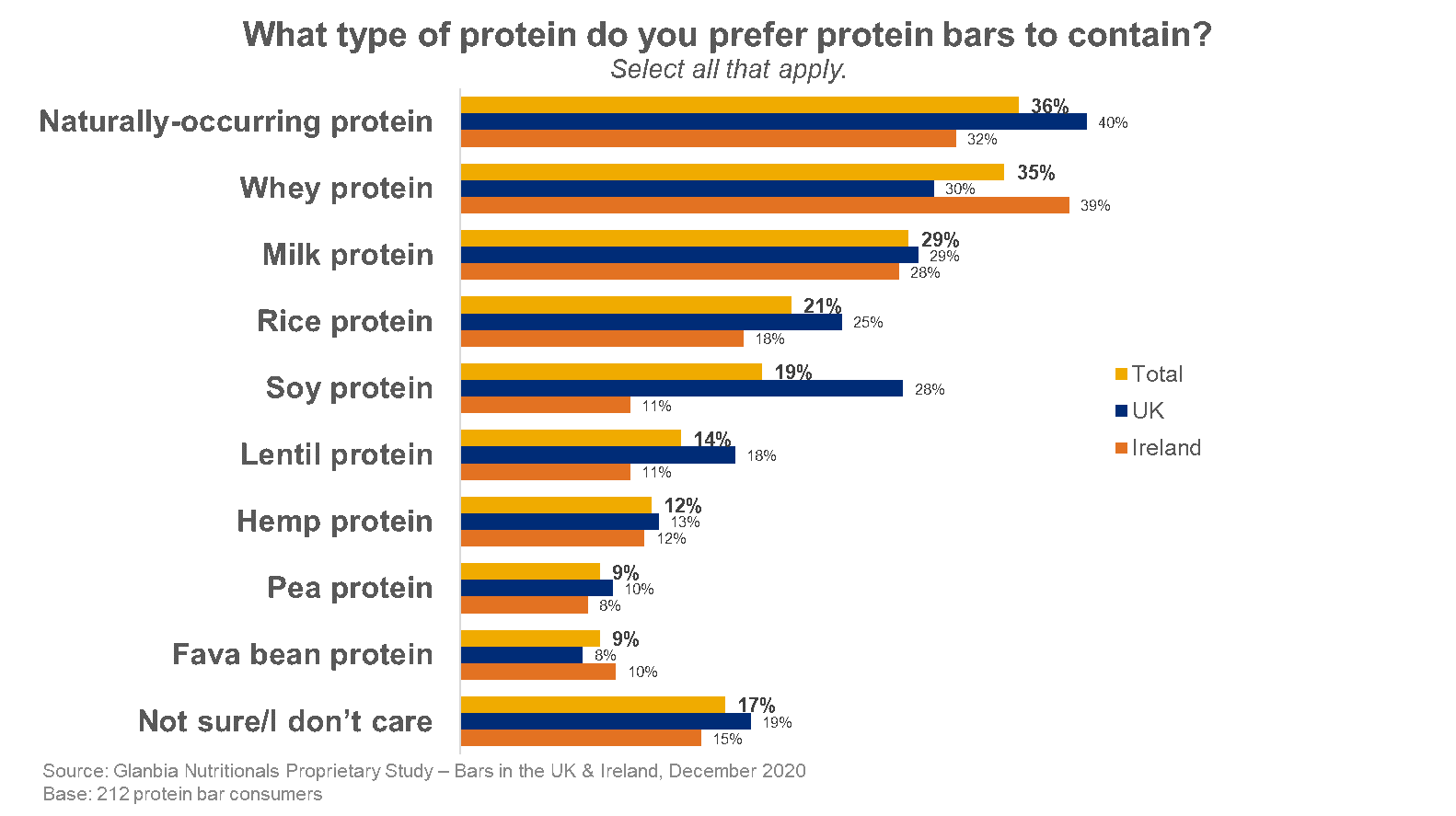

To understand UK and Irish consumers’ attitudes and behaviors around snacking, with a focus on bars, in particular, Glanbia Nutritionals went straight to the source. Our proprietary primary research study1 surveyed over 800 bar consumers (those that consume a protein bar or granola/cereal/snack bar at least every 6 months), split evenly between the UK and Ireland, to learn about their snack consumption and purchase habits, as well as what they’re looking for in these products.

Here’s a look at some of the top insights from our research—plus key takeaways for bar manufacturers.

Bar Preferences in the UK and Ireland

In looking at bar consumption, our study shows the consumption of granola/cereal/snack bars and candy bars is pervasive among bar consumers, with 96% eating granola/cereal/snack bars and 94% eating candy bars at least occasionally. In addition, nearly two-thirds of bar consumers in the UK and Ireland are consuming protein bars.