How Consumers are Responding to Out-of-Stock Products

Through ongoing surveys to understand consumer behavior changes around food in response to COVID-19, Glanbia has monitored trends such as the emerging preference for shelf-stable and bulk-packaged foods, the rise in online grocery shopping, and the increasing consumption of certain products such as protein and energy bars.

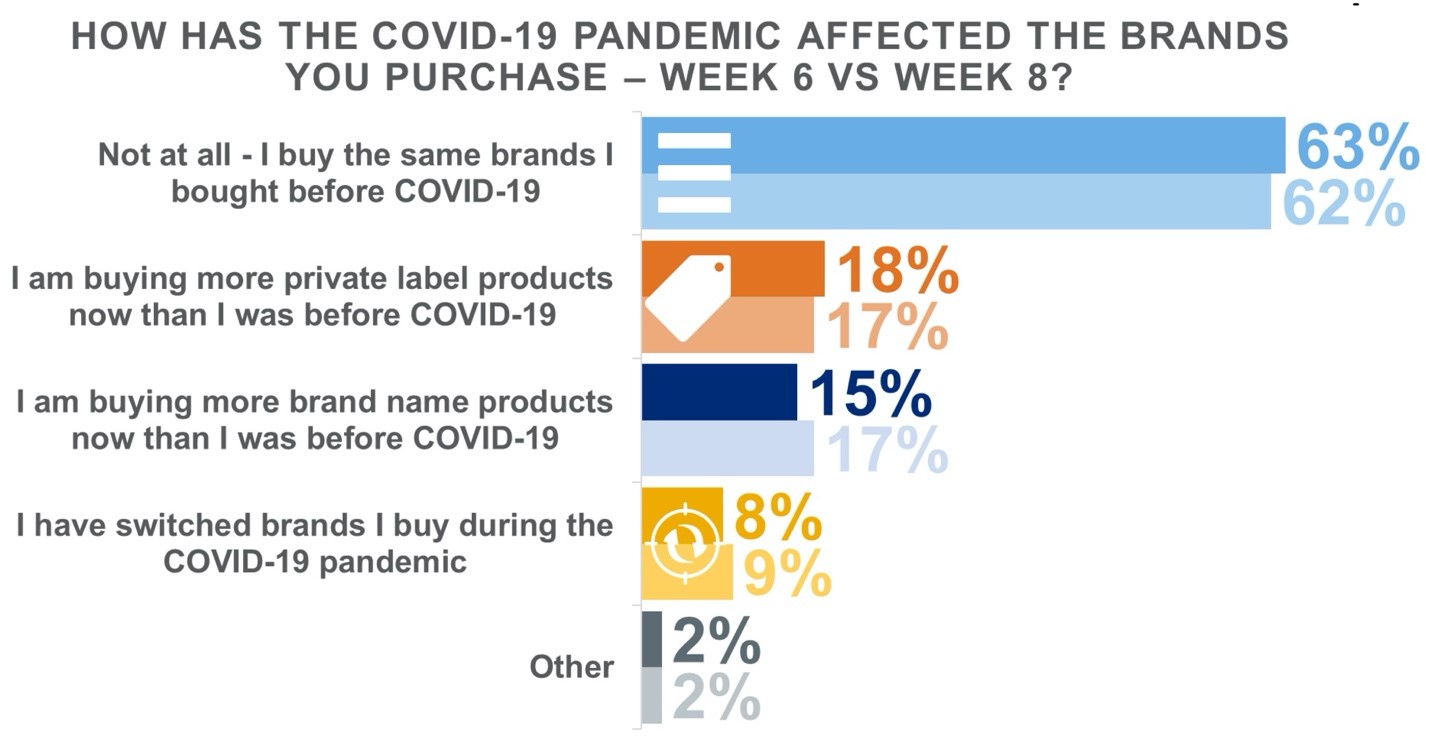

In Week 8 of our consumer survey research, we gained insights into how many consumers are still unable to find all of their preferred food and beverage products at the store and how they’ve been responding. Our results indicated that most consumers (66%) are currently able to find everything they need at the store they regularly visit. However, that leaves more than a third still struggling to complete their grocery shopping.

We learned that consumers responded to out-of-stock items in the following ways:

- Substituting their preferred brand with a different brand (16%)

- Visiting a different store to buy their preferred brand (10%)

- Going without the product (5%)