Glanbia’s Weekly COVID Consumer Tracker

In March of 2020, Glanbia Nutritionals initiated a monthly consumer survey to explore the impact of COVID-19 on consumers. This survey has been tracking consumer attitudes, beliefs, behaviors, and perceptions on a variety of topics, including:

- Food and supplement purchases

- Grocery shopping

- Home food preparation

- Diets

- Exercise behaviors

This ongoing survey has yielded valuable insights into trends and shifts throughout the length of the pandemic that directly affect the food and supplement industries. Here’s a look at where things stand today, one year after the pandemic began.

Health and Fitness at Home

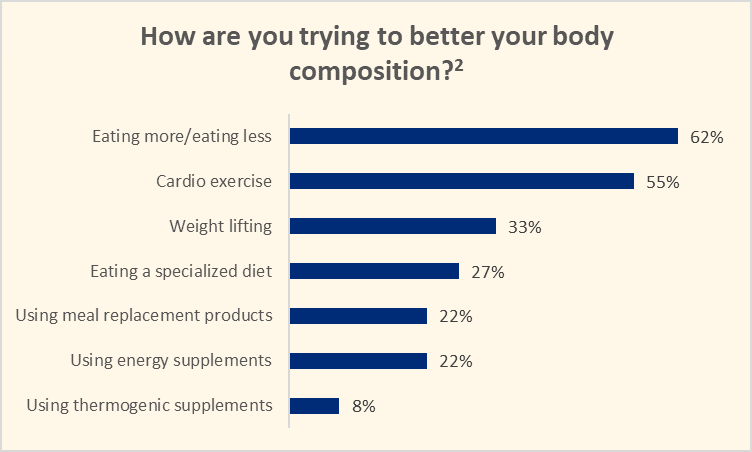

Some of the many lifestyle disruptions experienced due to COVID have included more time spent at home, along with reduced access to gyms and organized sports activities. In looking at what steps consumers are taking toward health and fitness goals going into 2021, our survey found the majority (63%) of consumers were working on their body composition, with calorie control and cardio as the primary strategies.1