What Consumers Are Looking for in Cheese

The cheese market is known for its incredible variety of products, with countless options available in terms of flavor, texture, format, and even nutrition. With that said, some distinct preferences have been emerging that impact the market.

HISPANIC CHEESES

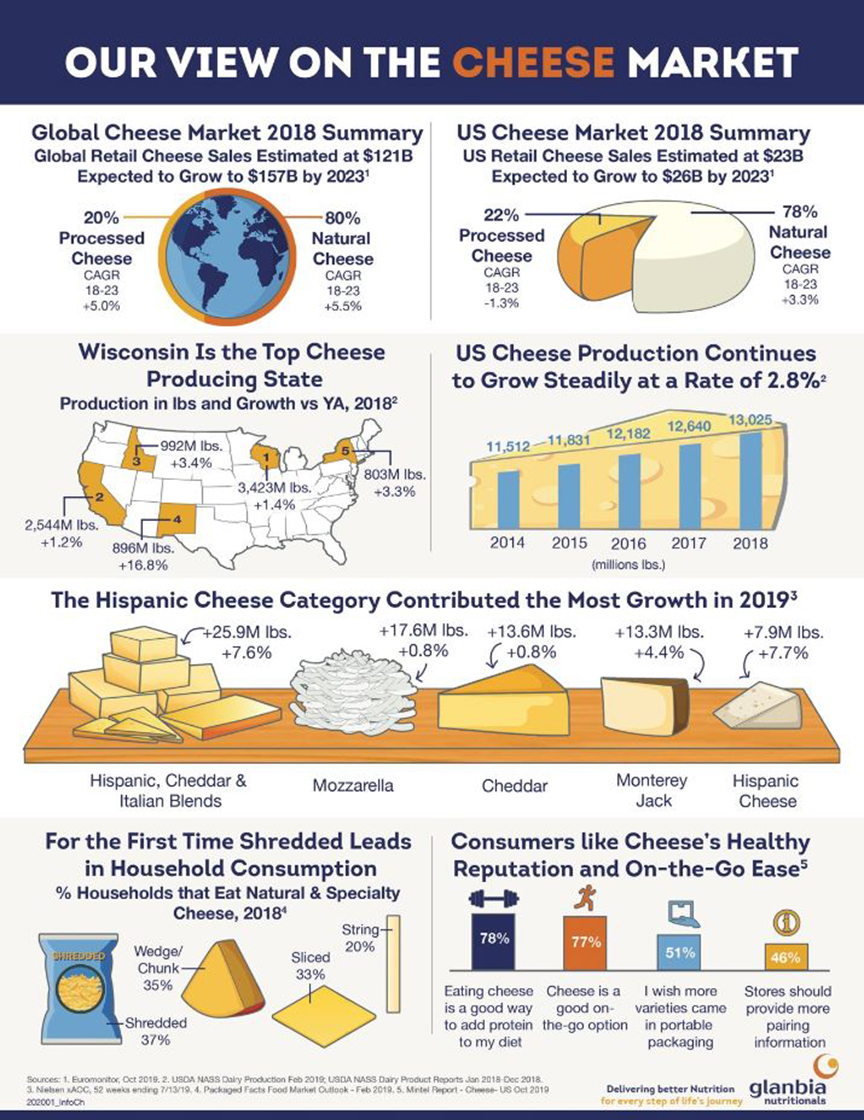

Hispanic cheeses are by far the fastest-growing segment in the U.S. cheese market, according to Nielsen data,3 showing 7.7 percent growth in 2019. The country’s Hispanic population growth, which continues to outpace the national average, is likely to sustain this trend for some time. In addition, interest in Hispanic cheeses among non-Hispanics is on the rise. Popular examples include Queso Fresco, Asadero, Manchego, Oaxaca, and Cotija.

SHREDS

Another shift underway in consumers’ preferences in product format. Packaged Facts4reports that shredded cheese is now the most popular cheese format, having overtaken chunk-type cheeses. The needs for convenience and versatility are likely contributing to this change.

PORTABILITY

Packaged Facts also notes that 20 percent of households that eat cheese are buying string cheese. This points to the inherent snackability of cheese and the potential to increase household penetration of snackable cheese formats. According to Mintel,5 77 percent of consumers view cheese as good on-the-go food, and 51 percent wish more varieties were available in portable packaging.

PROTEIN

Mintel also reports that 78 percent of consumers think eating cheese is a good way to add protein to the diet. With the protein trend still going strong, cheese manufacturers may wish to consider positioning some of their products as protein foods through front-of-package call-outs and other marketing efforts. Portable, snackable cheeses are especially likely to benefit from protein claims, allowing them to compete head-on with popular protein snacks such as jerky and bars.